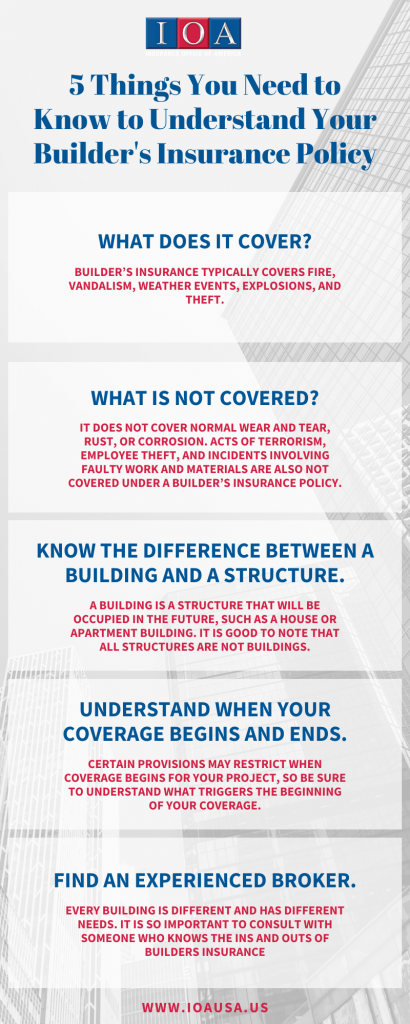

Understanding your insurance policy can be the difference between paying millions of dollars in damages and paying nothing at all. Which would you choose? Probably the pay nothing method, right? That is exactly why you need to understand your insurance policy backward and forwards. Here are 5 things you need to know to understand your builder’s insurance policy.

What does it cover?

Let’s start with the basics. What will your insurance policy cover? Builder’s insurance typically covers fire, vandalism, weather events, explosions, and theft.

Look out for costs related to lost sales, rental income, interest on loans, and real estate taxes when construction is delayed. You should also see if your policy covers damage to temporary structures, cleaning and debris removal, and construction site changes needed to meet environmental standards. Some policies include these services, but not all of them. Ensure you have the coverage that will meet your needs.

What is NOT covered?

Builder’s insurance typically doesn’t include damages from earthquakes, floods, and hurricane winds in beach zones. It also typically does not cover normal wear and tear, rust, or corrosion. These policies do not cover acts of terrorism, employee theft, and incidents involving faulty work and materials.

Know the difference between a building and a structure.

A building is a structure that will be occupied in the future, such as a house or apartment building. It is good to note that all structures are not buildings. If your contract requires coverage for a structure in addition to the building, you may not be covered if you need to file a claim, as some policies mention only covering a building or a structure.

Understand when your coverage begins and ends.

Certain provisions may restrict when coverage begins for your project, so be sure to understand what triggers the beginning of your coverage.

Builder’s insurance is temporary insurance, the end of your policy will likely end when your project has been completed. There are a few ways a project can be completed. These are the ways a policy can end: the policy can expire or be canceled, the building becomes occupied, which terminates the need for builder’s insurance, or the building has been put to its intended use.

Find an experienced broker.

Lastly, and probably the best advice we can give, is to find someone with years of experience. Every building is different and has different needs. It is important to consult with someone who knows the ins and outs of builder’s insurance. Your policy needs to meet your specific needs and an experienced agent can help find that policy for you.

Roger has 25 years of experience in the insurance world. He knows what he’s doing. At IOA, the brokers believe in partnering with their clients to achieve success. Roger wants to find every way he can mitigate risk for your business, contact him today.