Fires, locusts, pandemics, and hurricanes, what else does 2020 have in store? Claims and lawsuits. Bring it.

2020 has thrown us a few curveballs these last few months. Starting with Coronavirus, then the deadly hornets, the fires, and not to mention the hurricanes hitting the East Coast. It’s safe to say, we’ve all had our fair share. What else could 2020 have in store? Claims and lawsuits are likely on the horizon.

Similar to the economic downtown in ‘08 and ‘09, the numbers of litigation during the global pandemic have passed those unprecedented numbers. Litigation, class actions, and other legal matters have continued to grow over the last few months. Your HR team is likely overwhelmed with lawsuits and business-related COVID-19 issues. Help them manage these claims by partnering with an expert who knows how to protect your business.

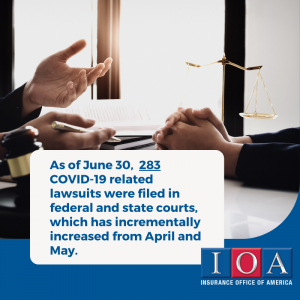

As of June 30, 283 COVID-19 related lawsuits* were filed in federal and state courts, which has incrementally increased from April and May.

Most of these claims come from business interruption claims, along with workers compensation, general liability, and a rise in cyber liability claims.

As far as business interruption and property coverage claims are concerned there are few things you, as a business owner, need to remember. First, your coverage is the ‘physical loss or damage’ of a property. This may not apply to COVDI-19 related closures.

Another thing to look out for when considering your business interruption insurance policy is specific exclusions. Especially those related to virus interruptions and pandemic exclusions. After the SARS outbreak of 2003, most insurance agencies have included some kind of pandemic exclusion in their all-risk and business interruption policies.

So, how can you ensure your business gets the most out of your claim?

You must report the claim within 30 days of the incident. If the workplace is contaminated or there is physical damage done you should be in good shape to receive a payout. Be sure to keep a detailed document of financial loss due to supplier issues because of COVID-19 and details surrounding the ‘clean up’ of the site.

How have these claims evolved since the start of COVID-19?

Worker’s compensation claims have skyrocketed over the last few months. As underwriters continue to look through these claims there are a few new specifications to allow a workers compensation claim to follow through. One major specification is that the employee’s illness must arise while they are at work. If your employee is going to the grocery store, to restaurants, and to other public places outside of the workplace, it is going to be difficult for an employee to prove that they contracted COVID within the office walls.

Another risk to consider that has evolved since the beginning of COVID-19 is negligence. As an employer, you have a duty to provide a safe working environment for your employees. If you are negligent in providing a safe work environment and one of your employees contracts COVID-19 in the workplace, you may be at risk for employee lawsuits.

How can you best protect your business in the future?

As we look to the future, it’s safe to say most businesses will be investing in some kind of pandemic policy. There are a few other coverages you may want to consider as you look to the future for your business.

First, an event cancellation policy. This will help to cover canceled events due to business interruptions if your policy includes pandemic and virus coverage. Be sure to check for viral exclusions and potential policy limits to better understand your business.

Some coverage that you also might want to consider from now into the future is cyber insurance. As workplaces continue to remain in a remote work environment, it has opened up an opportunity for cyber attacks. Cyber-attacks have increased immensely over the last few months. If you don’t have cyber insurance, get it today!

There is a lot to consider as an employer trying to keep your business open through one of the most devastating economic downturns. At IOA, we are experts in all things insurance. We want to help your business utilize all avenues possible to keep your business running effectively. Contact Roger today to learn how we can help your business.