When you partner with an insurance agency you should look for a company that can help lead you to success. At IOA we partner with your company to ensure your HR department is ready for any potential risk. IOA is not just insurance- we’re your HR partner as well. Here’s how we can help.

IOA uses Risk Score Analysis to ensure your business stays risk-free.

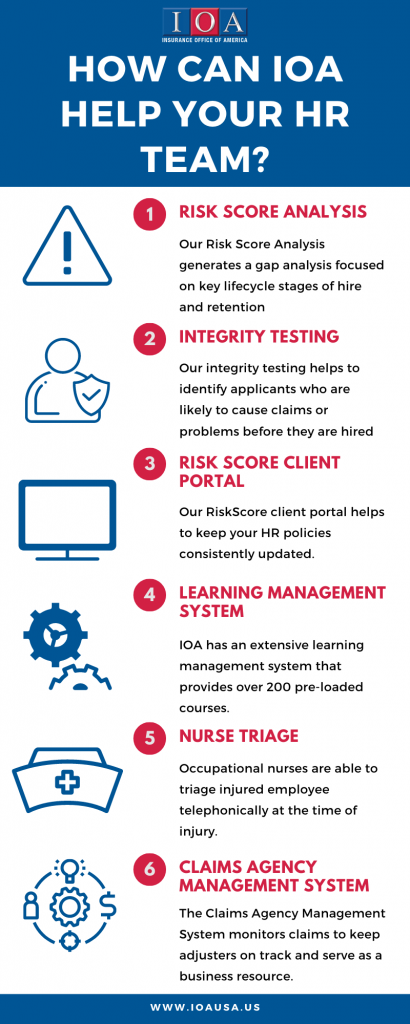

Our Risk Score Analysis generates a gap analysis focused on key lifecycle stages of hire and retention. With this information, we create solutions and implement best practices focused on reducing your insurance costs by reducing risk factors. This analysis helps your team develop a strategy to improve hiring, training, and claims management practices.

Integrity Testing

Our integrity testing helps to identify applicants that cause claims or problems before they are hired. One in five applicants fail this test. The integrity test covers subjects such as theft, dishonesty, drug and alcohol abuse in the workplace, and violence and bullying.

RiskScore Client Portal

Our RiskScore Client portal helps to keep your HR policies consistently updated. This helps to ensure you are up to date with compliance changes and updates. It also keeps both your company and your people safe from potential harm and risk.

Learning Management System

IOA has an extensive learning management system that provides over 200 preloaded courses that explain OSHA requirements, safety protocols, customer service, HR, and wellness. This system is used to provide relevant and consistent training to new hires on safety topics that are pertinent to their jobs. As there are various training to choose from, this LMS allows your team to customize and create learning modules of their own.

Nurse Triage

Occupational nurses are able to triage injured employees telephonically at the time of injury. Workplace injuries typically do not require clinical level treatment, an occupational nurse on call 24/7 can be extremely helpful to mitigate your risk as a business and keep your costs down and employees safe from further harm. Not only does it keep your employees safe, but it helps to keep a record of employee, supervisor, and witness statements at the time of the accident to defend claims that may become litigated.

Claims Agency Management System

Lastly, the Claims Agency Management System monitors claims to keep adjusters on track and serve as a business resource. This system gives your business unlimited access to a dedicated claims advocate that is an all lines licensed adjuster. It provides regular monitoring for problematic claims, proactive monitoring of all expired policy open claims, and creates a timeline of claim events that organize employers worker’s compensation documents. Not only does this system monitor your current and previous claims, but it also ensures you remain OSHA compliant with OSHA log and reporting.

At IOA, we go beyond offering insurance to our clients. We want to partner in your success. Each broker at IOA is a business owner themselves, we understand what it takes to run an effective company and see success. Do you need an insurance agent that partners in your success? Contact Roger today.