Last year was tough for most industries having to adjust to the ‘new normal’ brought upon by COVID-19. The real estate industry specifically is one that had to be creative with approaching the unknown. One major area of change we will likely see in the new year deals with real estate taxation. As we continue into 2021, there are a few tax implications real estate investors, owners, and professionals should consider moving forward.

Changes to the taxation policy due to the election

The first of these tax implications real estate professionals need to consider are the changes to the taxation policy from the new administration. Anytime a new administration takes office, there will be changes. It’s important to understand these adjustments and get ahead of them, so you can ensure your success.

The main changes proposed to tax law that would directly affect the real estateindustry include:

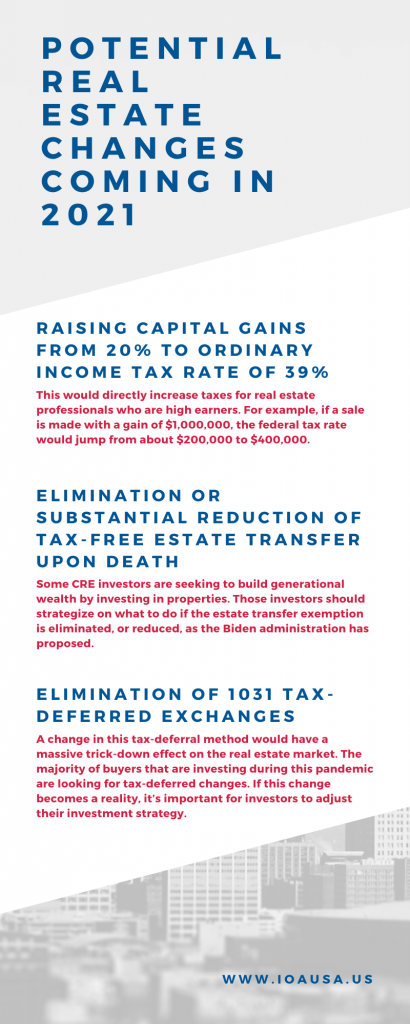

Raising capital gains from 20% to ordinary income tax rate of 39%

The most likely and immediate change would be raising the capital gains tax rate to an ordinary tax rate level. This would directly increase taxes for real estate professionals who are high earners. For example, if a sale is made with a gain of $1,000,000, the federal tax rate would jump from about $200,000 to $400,000.

When investors see this large of a jump in taxation, their behavior will likely change. It is likely investors will hold on to assets– especially ones with the investor basis low compared to the market value. It also might make sense for investors to put a long-term debt piece on asset, so they can benefit from the cash flow and potentially take some money out tax-free.

Elimination or substantial reduction of tax-free estate transfer upon death

Some CRE investors are seeking to build generational wealth by investing in properties. Those investors should strategize on what to do if the estate transfer exemption is eliminated, or reduced, as the Biden administration has proposed. Currently, the tax law (which expires in four years) allows investors to gift up to $11,500,000 per individual in a tax-free exemption upon death.

In addition, there is some potential risk associated with changing the ability to step up and investor’s basis on estate-included assets. If these proposed changes go through, investors might consider refinancing with additional tax-free loan proceeds from long-term debt.

Elimination of 1031 tax-deferred exchanges

The last change that real estate investors should look out for when it comes to the new administration’s changes deals with 1031 exchanges. These have not yet become a widely-discussed reality, and CRE investors hope it stays that way!

A change in this tax-deferral method would have a massive trick-down effect on the real estate market. The majority of buyers that are investing during this pandemic are looking for tax-deferred changes. If this change becomes a reality, it’s important for investors to adjust their investment strategy.

Changes to these tax policies could have a significant impact on the CRE market and transaction volume. It’s important that you remain prepared to adjust your strategy if these modifications occur. It is likely that if these modifications become a reality, transaction volume will be significantly lower, as sellers are challenged with a tax burden and can not find a suitable alternative investment.

There is potential that refinance transaction volume may be larger than acquisition finance this year. As an investor, you can look to insurance companies as a lender for long-term debt. Insurance companies offer the best combination of non-recourse debt with estate planning that can be tailored to a borrower’s future goals.

Roger J Stewart is an expert in insuring real estate professionals to make sure they remain risk-free in an ever-changing market. Contact Roger today to see how he can help!