In the last 10 months, we have gone from a booming economy to one of the worst economies in US history. Financing debt and understanding your risk has become a top priority for most business owners.

With an added focus on receiving payments, and acquiring finances to fund your business, the market for surety bonds has grown. These bonds offer an important secondary level of coverage.

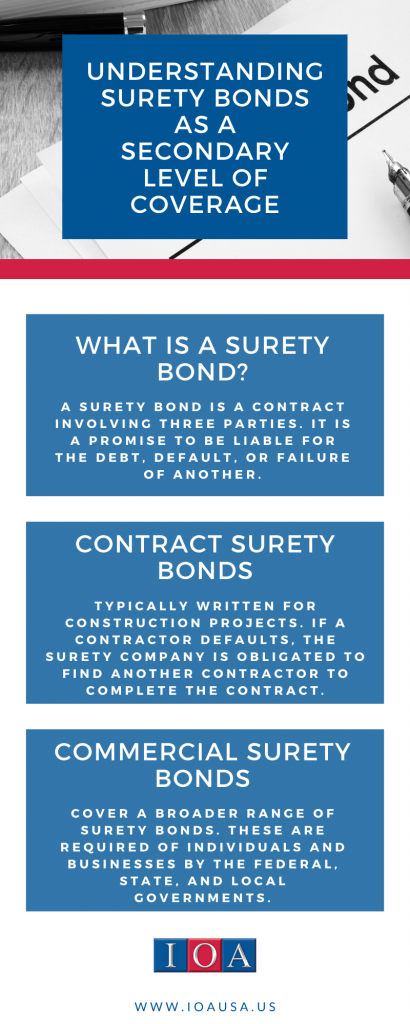

Let’s start with what a surety bond is.

A surety bond is a contract involving three parties. It is a promise to be liable for the debt, default, or failure of another. These three parties include:

- The principal: that party that purchases the bond and undertakes the obligation to perform the act as promised

- The surety: an insurance company that guarantees the obligation is performed. If the principal fails to perform the act as promised, the surety has a contractual obligation for the losses.

- The obligee: The party who requires and receives the benefit of the surety bond.

There are two categories of surety bonds, including contract surety bonds and commercial surety bonds.

Contract Surety Bonds

Contract surety bonds are typically written for construction projects. The surety company must find another contractor to complete the contract if a contractor defaults. Another option for the surety company is to compensate the project owner for the financial loss incurred. There are a few bond types of contract surety bonds, including:

- Bid bond: This bond provides financial protection to the owner if the bidder fails to perform the required job, or sign the contract.

- Performance bond: this bond gives the owner a guarantee, if the contractor defaults the surety will be completed.

- Payment bond: A payment bond makes sure specific subcontractors and suppliers receive payment for labor and materials used during construction.

- Warranty bond/Maintenance bond: This bond ensures protection for the owner. If any workmanship/ material defects are found in the original construction they will be repaired during the warranty period.

Federal construction contracts valued at $150,000 or more require contract surety bonds. State and municipal governments have similar regulations. Private owners can also use contract sureties.

Commercial Surety Bonds

Commercial surety bonds cover a broader range of surety bonds. Federal, state, and local governments require individuals and businesses to utilize these bonds.

The government may require these bonds to obtain a license. For example, mortgage brokers, contractors, and auto dealers need these bonds to obtain a license or permit bond. In order to protect various statutes, regulations, ordinances, and other government entities, these bonds may be required.

Beginning your surety bond process is not difficult. If you have financial obligations to meet, consider surety bonds. Consider your company’s credit, where and why you will use the bond.

Once you’ve considered your credit, reach out to your risk manager. Risk advisors, like Roger J Stewart, can help you work with underwriters and determine your capacity for surety bonds.